Introduction

Cochin Shipyard Limited (CSL) is one of India’s leading shipbuilding and maintenance companies, and its Cochin Shipyard share has attracted significant attention from investors in 2025. Listed on both NSE and BSE, CSL shares represent a promising investment opportunity in the maritime and defense sectors. In this blog, we delve into the latest share price trends, company performance, and investment outlook to help you make informed decisions.

Overview of Cochin Shipyard Limited

Established in 1972 and headquartered in Kochi, Kerala, Cochin Shipyard Limited is a government-owned PSU known for building a variety of vessels, including naval warships, tankers, and offshore platforms. The company also offers repair and maintenance services, making it a critical player in India’s maritime infrastructure.

The shipyard’s strategic importance and government backing add to its stock’s appeal among investors looking for steady growth in PSU stocks.

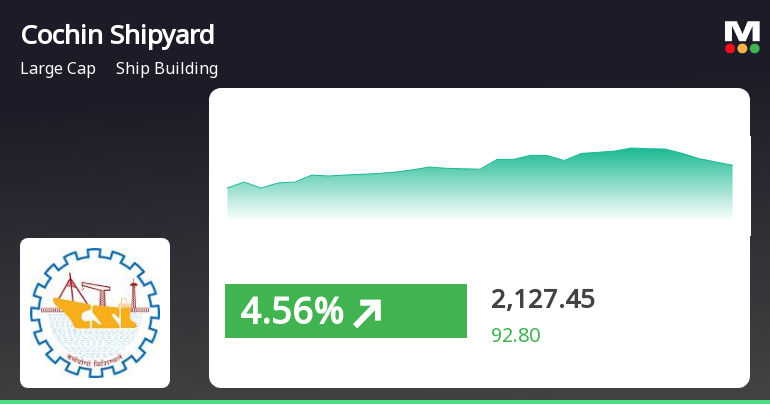

Cochin Shipyard Share Price Trends in 2025

The Cochin Shipyard share price has seen fluctuations throughout 2025, influenced by several factors such as government contracts, global shipping demand, and quarterly financial results. The share price as of June 2025 hovers around ₹380-₹400 per share on NSE, reflecting investor confidence in the company’s expansion plans.

- Q1 2025 Results: CSL reported a healthy increase in revenue due to new naval shipbuilding orders.

- Market Sentiment: Positive news about defense contracts and India’s Make in India initiative for shipbuilding helped boost shares.

- Global Factors: Fluctuations in international shipping rates and supply chain disruptions continue to impact investor sentiment.

Investment Analysis: Is Cochin Shipyard a Good Buy?

For investors seeking exposure to the maritime and defense sectors with government backing, Cochin Shipyard offers a compelling opportunity. Here’s why:

- Strong Order Book: CSL has secured multiple contracts from the Indian Navy, including advanced warships and support vessels.

- Dividend Payout: The company has a consistent track record of dividend payments, making it attractive for income-focused investors.

- Government Support: As a PSU, CSL benefits from policy support, subsidies, and preferential orders.

- Expansion Plans: The shipyard is investing in new technologies like LNG-powered ships and green shipping solutions.

However, investors should be aware of risks such as cyclical shipping demand, global economic slowdowns, and delays in contract execution.

How to Buy Cochin Shipyard Shares?

You can purchase Cochin Shipyard shares through your stockbroker or online trading platforms. It is listed under the ticker COCHINSHIP on NSE and BSE. Before investing, consider analyzing the latest quarterly results available on the BSE India website or NSE India portal.

Latest News and Updates

- In April 2025, CSL signed a landmark contract with the Indian Navy to build five advanced frigates over the next decade.

- The company is also expanding its dry dock facilities to cater to larger vessels.

- Efforts towards sustainable shipbuilding and adoption of green energy technology are underway.

Conclusion

Cochin Shipyard share remains a promising option for investors interested in India’s growing maritime sector and PSU stocks. Its stable order book, government support, and growth initiatives provide a strong foundation for future growth. However, as with all stock investments, careful research and risk assessment are essential.

Stay updated with the latest Cochin Shipyard share price and company news to make timely investment decisions.

Looking for more PSU stock insights? Check out our detailed guide on Top PSU Stocks to Watch in 2025.