Introduction

With inflationary pressures rising globally, protecting your portfolio is more crucial than ever. While no single asset class can guarantee protection against inflation, diversifying with a strategic mix of investments can help reduce risk and improve resilience. In this guide, we’ll explore seven smart ways to inflation-proof your portfolio and ensure long-term growth and stability.

1. Invest in Stocks

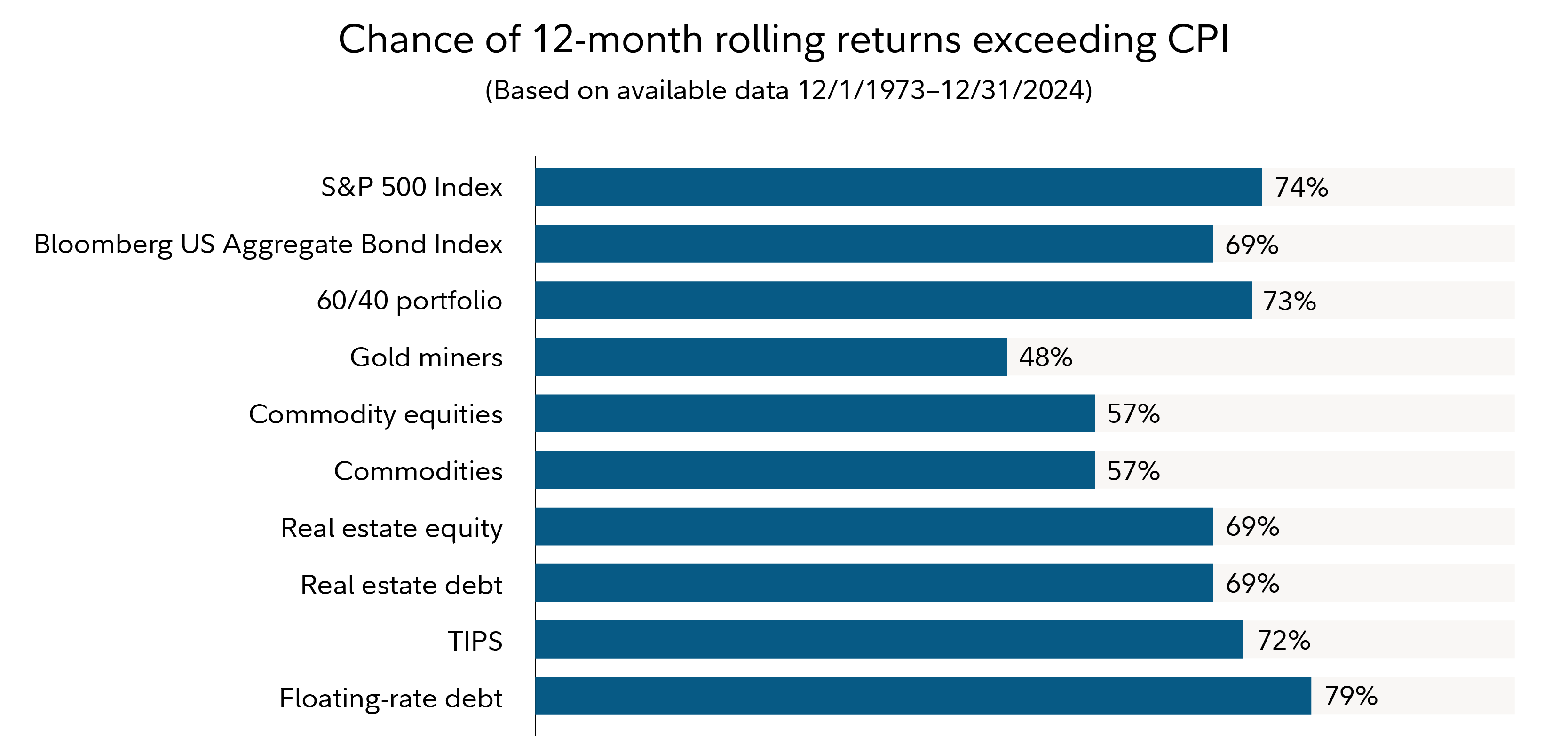

Stocks offer long-term growth potential and have historically outpaced inflation. Companies can raise prices to offset inflation, helping maintain earnings. Consider broad market exposure and dividend-paying stocks for added stability.

2. Diversify with International Stocks

Non-U.S. stocks can provide a hedge when the dollar weakens due to inflation. Currency benefits and exposure to global growth trends enhance portfolio diversification and inflation protection.

3. Use Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds indexed to inflation, with principal and interest payments that rise with the Consumer Price Index (CPI). They provide stable, low-risk inflation protection within the fixed-income portion of your portfolio.

4. Add Gold to Your Mix

Gold has long been viewed as a hedge during inflationary and stagflationary periods. Though volatile and non-yielding, a modest allocation to gold can help balance risks during inflation spikes.

5. Gain Real Estate Exposure

Real estate often appreciates with inflation and can provide rental income that rises with market rates. REITs (Real Estate Investment Trusts) offer a convenient way to invest in real estate while maintaining liquidity and diversification.

6. Consider Floating-Rate Loans

Floating-rate debt adjusts with interest rates, offering protection when rates rise with inflation. These loans are often issued by lower-rated companies, so understanding credit risk is essential. They’ve historically outperformed in inflationary environments.

7. Invest in Commodities

Commodities like oil, agriculture, and industrial metals can surge during inflation shocks. Diversified commodity ETFs or mutual funds can provide exposure while managing volatility and sector-specific risks.

Conclusion

No single asset class offers a complete shield from inflation. The best defense is a diversified strategy that blends growth, income, and inflation-resistant assets. Regularly reviewing and adjusting your portfolio ensures it stays aligned with changing economic conditions. Talk to a financial advisor to tailor a plan suited to your goals and risk tolerance.

Explore strategies for navigating market volatility for more insights.

For a deeper understanding of how TIPS, gold, and other inflation hedges perform historically, check out Fidelity’s guide to TIPS and inflation protection.