Introduction

India’s economic growth story continues to shine, with GDP forecasted to grow at a robust 6.5% in FY25. Yet, private investment remains a laggard, growing at a slower 6.1%. The disconnect between soaring GDP figures and muted private capital formation has puzzled economists and policymakers alike. Here’s a deep dive into 7 key factors contributing to this unusual divergence.

1. Private Corporations Are Turning Into Net Savers

Private non-financial corporations have steadily increased their share of gross savings—from 23.9% in FY12 to 31% in FY24. Meanwhile, household savings have declined. Instead of reinvesting profits into new assets, many corporates are parking funds in safer avenues, reflecting a cautious stance post the twin balance sheet crisis of the 2000s.

2. Declining Investment-to-Output Ratio in Manufacturing

Manufacturing, a sector long hailed as India’s growth engine, has seen its investment-to-output ratio fall from 9.4% in FY12 to 7.3% in FY24. This suggests reluctance to invest despite various government incentives such as PLI schemes. Ironically, agriculture outperformed, with its ratio increasing from 14.1% to 16.4% in the same period.

3. Public Capex Can’t Carry the Load Alone

The recent surge in fixed investment is driven largely by government-led capital expenditure, particularly by the Centre and in sectors like railways. However, a reallocation of state budgets toward revenue expenditure has dampened overall momentum. This shift is unlikely to ignite sustained private investment on its own.

4. Slowing Conversion of Intended Capex into Actual Investment

According to researchers Renu Kohli and Kritima Bhapta, only 10% of intended private capex translated into actual gross fixed capital formation between FY17–FY23. This is significantly lower than 47.4% in the 1990s and 33.4% in the 2000s, reflecting reduced corporate risk appetite.

5. A Shift Toward Intellectual Property and Intangibles

Private non-financial firms are increasingly investing in intellectual property—up from 5.9% of total fixed investment in FY12 to 9.5% in FY24. Meanwhile, investment in machinery and equipment dropped to 14.3%. This pivot to intangibles suggests a restructuring of capital allocation priorities, possibly toward tech and R&D-heavy sectors.

6. Lack of Confidence in Sustained Demand

Despite strong headline growth—9.2% in FY24 and 7.6% in FY23—many corporates appear unconvinced of long-term consumer demand. This lack of visibility may explain why even recent growth spurts failed to catalyze significant new investment.

7. Global Uncertainty and Protectionism

Geopolitical developments and economic nationalism—such as former U.S. President Donald Trump’s protectionist policies—have increased external uncertainty. In such an environment, Indian corporates are likely to remain cautious, choosing financial prudence over ambitious capital spending.

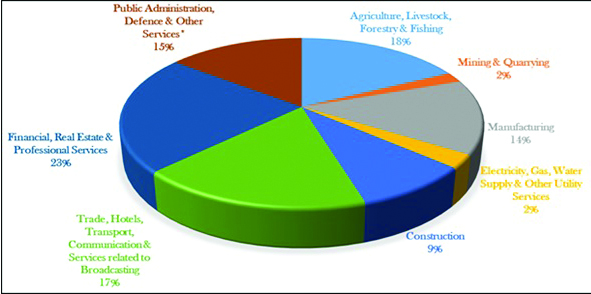

Despite economic policy emphasis on manufacturing, there’s been a lackluster response from industry. Manufacturing as a proportion of gross value added has fallen from 17.4 percent in FY12 to 14.3 percent in FY24.

The decline in the share of manufacturing may partially explain private investment trends. Investment-to-output ratio in manufacturing has declined from 9.4 percent in FY12 to 7.3 percent in FY24. This trend is at odds with even agriculture, where investment-to-output ratio has increased from 14.1 percent to 16.4 percent over the same period. It’s not as if agriculture hasn’t faced its share of problems in the last decade.

A plausible explanation for this puzzle is that quite a few decision makers in the private sector are probably not seeing enough underlying strength in demand to commit themselves in a significant way to investment. Even this explanation is hard to reconcile with at least two growth spurts over the last 15 years which didn’t seem move the needle. If anything, private non-financial corporations are even more enthusiastic to save now.

Or, perhaps we are in the midst of a large underlying shift in factors which influence private investment and it’s too early to get a clear sense of it.

One thing that is not going to catalyse private investment at this juncture is the significant level of uncertainty introduced into the global economic environment by the full-blown economic protectionism advocated by U.S President Donald Trump.

Conclusion

The weakening link between India’s GDP growth and private investment reveals deeper structural and behavioral shifts. From post-crisis caution to global uncertainty and evolving investment preferences, the puzzle of subdued private capex may not have a quick fix. But understanding these trends is essential if India is to truly unlock the next phase of its growth story.

For more on sectoral shifts and manufacturing decline, read our deep dive: India’s Manufacturing Conundrum.