Table of Contents

Stock Market Today Fed Rate Cut – Market Opens With Caution

The stock market today Fed rate cut narrative dominated Wall Street as U.S. equities opened Monday with little momentum. Investors appeared reluctant to make aggressive bets ahead of the Federal Reserve’s final policy meeting of 2025, scheduled to begin Tuesday.

With expectations largely priced in, traders focused on preserving recent gains rather than pushing markets decisively higher or lower. Volumes remained moderate, reflecting caution rather than panic or exuberance.

Indexes Show Limited Movement

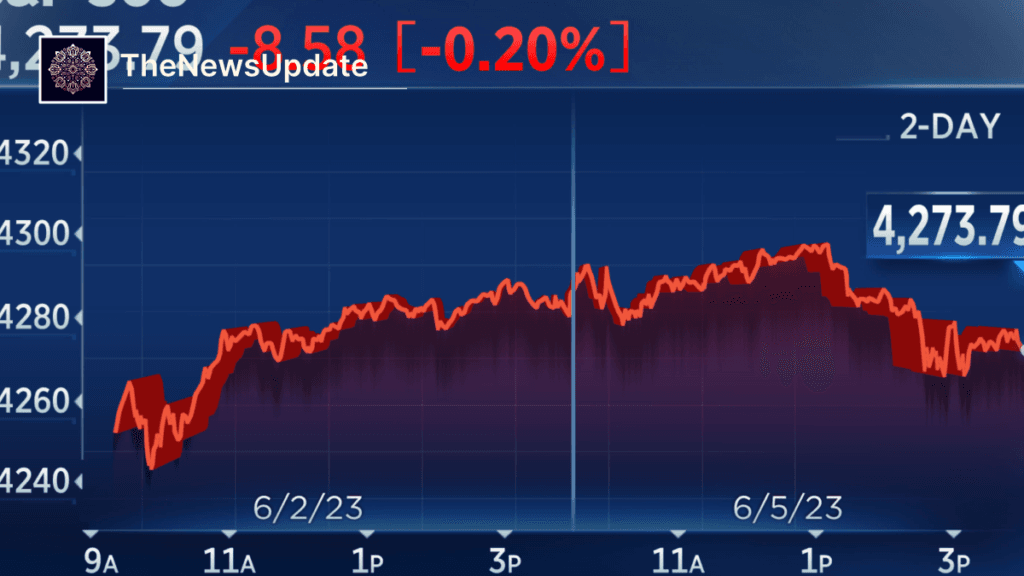

The tech-heavy Nasdaq Composite edged higher by around 0.2%, supported by select large-cap tech names. Meanwhile, the S&P 500 hovered just below the flatline, struggling to find direction.

The Dow Jones Industrial Average slipped roughly 0.1%, giving up some of its recent gains after closing higher last week. Futures tied to major indexes also reflected subdued sentiment, signaling stability rather than volatility.

Overall, the stock market’s calm tone suggested investors were waiting for confirmation rather than reacting prematurely.

Fed Rate Cut Expectations Grow

Markets are increasingly confident that the Federal Reserve will deliver an interest rate cut this week. According to CME FedWatch data, traders now see an 88% probability of a rate reduction, up sharply from 67% just a month ago.

This shift follows a favorable September personal consumption expenditures (PCE) inflation report, which helped reinforce hopes that price pressures are easing. That data supported back-to-back weekly gains for major U.S. equity benchmarks.

However, not all policymakers are aligned. Some Fed officials remain concerned that inflation could remain stubborn, complicating the policy outlook beyond this meeting.

Economic Data in Sharp Focus

With interest rate expectations largely formed, investors are now turning their attention to key economic releases scheduled for the week. Labor market data will be closely watched following mixed signals in recent reports.

Notably, the delayed October Job Openings and Labor Turnover Survey (JOLTS) report is set to be released on Tuesday. The data will provide fresh insight into hiring trends, layoffs, and worker mobility.

These indicators could play a critical role in shaping expectations for monetary policy in 2026, where uncertainty remains significantly higher.

Corporate Moves Shake Media Stocks

Outside of macroeconomic developments, corporate news offered moments of volatility. Paramount Skydance launched a surprise $108 billion hostile bid for Warner Bros. Discovery, sending WBD shares nearly 7% higher.

The move disrupted expectations around a potential Netflix acquisition, causing Netflix stock to pull back as investors reassessed the competitive landscape. Paramount shares gave up earlier gains but remained in focus throughout the session.

Such corporate actions added complexity to an otherwise restrained trading environment.

Earnings and What’s Next

Attention will soon shift to a busy earnings calendar. Oracle and Adobe are scheduled to report results on Wednesday, while Broadcom and Costco headline Thursday’s releases.

Earnings performance could either reinforce confidence or introduce fresh volatility, especially as valuations remain elevated in several sectors.

For now, the stock market today reflects a holding pattern as Wall Street waits for the Federal Reserve to deliver long-anticipated policy clarity.

Read More

Read More:

https://finance.yahoo.com/news/live/stock-market-today-dow-sp-500-nasdaq-steady-with-wall-street-awaiting-expected-fed-rate-cut-001431798.html?guce_referrer=aHR0cHM6Ly90cmVuZHMuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAABNthDUG_dEw-p5DhCAALY_a-B6v4VUuENf0e1KU1e3VIa6mL7cX5xy9mMUeY7KERJm2qqQhmLRxADtOvxH4PbDGJC5_EWtscE41M6rkkNosNI6wgjPGmbX4M0HKDar3nCiIT8dDlCI5DQqg5zFG16lAtJsxlos2Eye58IRjKPvo

https://themorningnewsinformer.com/sbi-kotak-marico-bpcl-hpcl-iocl-adani-group-shares-among-buzzing-stocks-may-5-2025/

https://themorningnewsinformer.com/westpac-profit-miss-2025-global-trade-risk/